Introduction

Elon Musk, the well-known entrepreneur and visionary behind Tesla, has often been in the news for his lavish spending habits as well as the ambitious initiatives that he has undertaken. It is essential to investigate the link between Musk's financial choices and the price dynamics of the firm, particularly in light of the current buzz around Tesla's pricing strategy.

In this piece, we look into the subject of Elon Musk's spending and how it has a direct affect on Tesla's pricing, concentrating primarily on price decreases and price cuts made by Tesla.

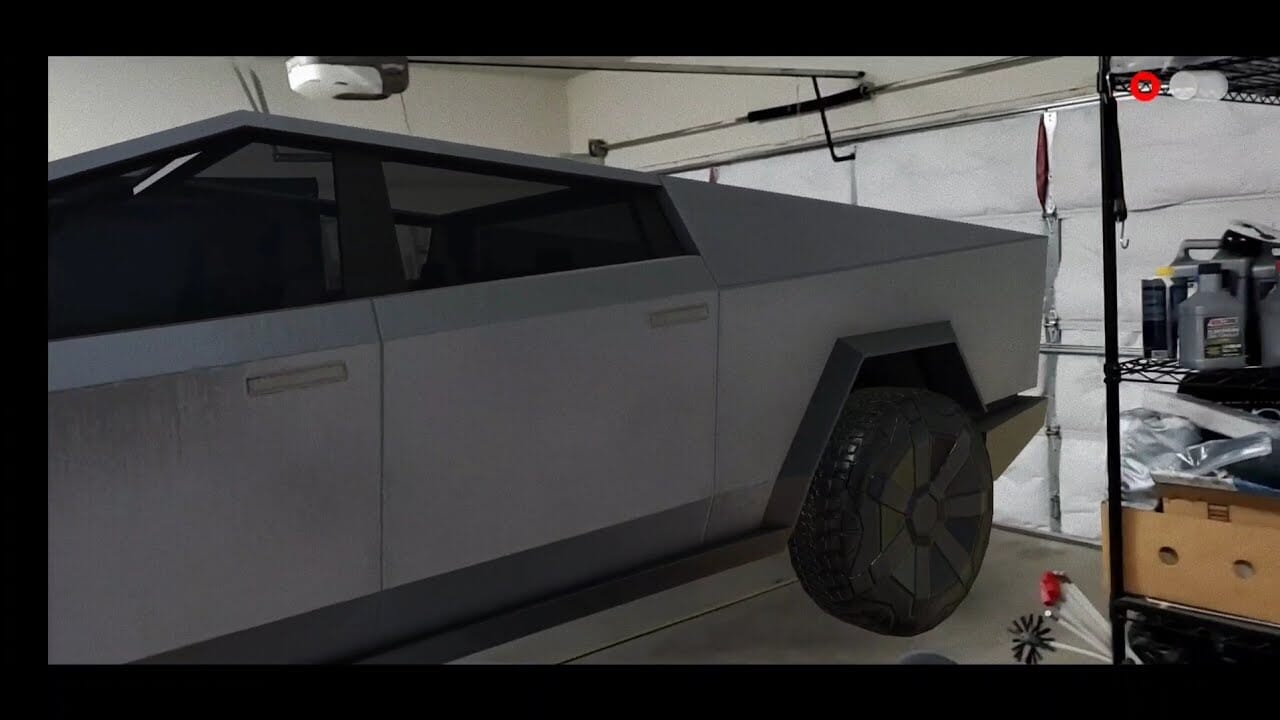

See Also: IS THE CYBERTRUCK COMING OUT?

Understanding Elon Musk's Spending Habits

Elon Musk, who is well-known for his daring business endeavors such as SpaceX and Neuralink, has constructed an empire based on pioneering technological advancements. Beyond these endeavors, he has an entrepreneurial mentality that often results in major personal investments.

Musk engages in a wide variety of spending activities, some of which include charity, the purchase of real estate, and even self-funded companies like The Boring Company.

Elon Musk's Extravagant Purchases and Their Ripple Effects

Repeatedly, the public's attention has been drawn to Elon Musk's propensity for making extravagant purchases. Musk's spending tendencies resonate across the financial world, whether he is sponsoring space research, purchasing luxurious houses, or acquiring historic assets like the James Bond underwater vehicle. But how exactly do these lavish expenditures relate to Tesla's pricing strategies?

The Link Between Elon Musk's Spending and Tesla Price Drops

When news regarding Elon Musk's personal investments makes headlines, it often gives rise to rumors and conjecture about how such investments could affect Tesla's prices.

The high-profile purchases and ambitious initiatives that Elon Musk is involved in sometimes give the impression that the entrepreneur is struggling financially. This view, in turn, may have an influence on the confidence of investors in Tesla, which may lead to price decreases in the stock market.

The Role of Perception in Tesla Price Cuts

Tesla is not an exception to the rule that the perception plays a significant influence in the automobile business. The manner in which Elon Musk spends his money may have an effect on how the public views Tesla's capacity to sustain its operations financially.

The stock price of Tesla might go down if investors get the impression that the firm is struggling financially, which would be a bad sign for the company. Tesla may decide to lower some of their prices strategically in order to combat this notion and preserve the trust of the market.

See Also: WHAT CYBERTRUCK TO ORDER?

Tesla's Pricing Strategy: Balancing Market Demand and Competition

Although Elon Musk's spending choices have the ability to have an effect on Tesla's prices, the pricing strategy of the firm is also driven by the demand in the market and the competition in the industry.

Tesla continually analyzes the current market conditions in order to establish the most appropriate prices for its electric automobiles. Price reductions and price drops are two different strategies that may be used to break into new markets, fight off rivals, or increase demand at certain times of the year.

See Also: CAN CYBERTRUCK TOW?

Frequently Asked Questions (FAQs)

Q1: How does Elon Musk's personal spending affect Tesla's stock price?

A1: The personal expenditures of Elon Musk might give the impression that he and, by extension, Tesla are under a significant amount of financial hardship. This view may have an effect on the confidence of investors, which might ultimately result in a decrease in Tesla's stock price.

Q2: Are Tesla price drops solely linked to Elon Musk's spending habits?

A2: No, The demand in the market, the level of competition, and the circumstances of the economy as a whole are all elements that contribute to price decreases for Tesla vehicles. Although Musk's spending may have an effect on how investors see the company, it is not the only factor contributing to price declines.

Q3: Why does Tesla resort to price cuts?

A3: In order to preserve the trust of the market, to increase demand, or to combat any unfavorable perceptions around the company's financial soundness, Tesla may resort to deliberately lowering its prices.

Q4: How does Tesla's pricing strategy differ from other automotive companies?

A4: The pricing approach that Tesla employs is one of a kind owing to the company's emphasis on electric cars and cutting-edge technology. The company's objective is to strike a healthy balance between the demands of the market, the intensity of the competition, and the level of profitability while simultaneously advancing the cause of environmentally friendly energy.

Conclusion

The excessive spending habits of Elon Musk have been a subject of mystery and conjecture, in particular with regard to the influence that these habits have on the price dynamics of Tesla. Although it is true that Musk's personal investments and high-profile acquisitions might impact the view of investors and perhaps lead to price decreases in Tesla's shares, it is also true that these factors are not the only factor in determining how the firm decides to price its products.

The demand in the market, the level of competition, and the state of the economy as a whole all factor into Tesla's price choices. This information is considered on an ongoing basis by the firm in order to arrive at the most reasonable cost for its electric cars. Tesla uses price cuts and price decreases as strategic tactics to preserve market trust, increase demand, and guarantee that it maintains its competitive advantage in the automobile sector.

It is vital to note that Elon Musk's spending habits should not be regarded in isolation but rather as part of his visionary approach to innovation and investment. This is something that should be recognized since it is significant. It is clear that he is committed to pushing limits and promoting technologies that have the potential to transform industries, as seen by the ambitious undertakings he undertakes and the personal purchases he makes.

It is essential for customers and investors to conduct a comprehensive analysis of Tesla's price dynamics. This analysis should take into account both internal and external variables that impact the decision-making processes of the firm. If we do this, we will be able to have a better grasp of how Tesla's price approach corresponds with its aims of transforming the automotive industry and creating more environmentally friendly transportation options.

In conclusion, while Elon Musk's personal spending habits obviously generate interest and conjecture, the influence on Tesla's price extends much beyond Musk's individual purchases. Pricing choices at Tesla take a number of factors into account, including market demand, industry competitiveness, and strategic goals. This is done to assure the company's continued success in a sector that is always changing.

Here's a YouTube video on the Tesla price cuts and drops: